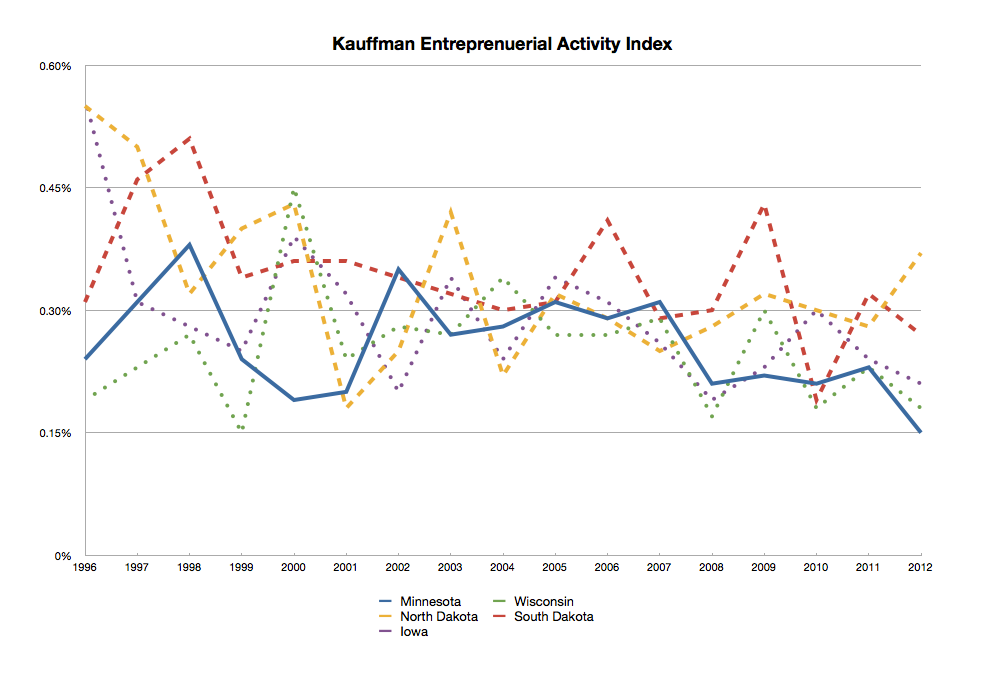

Minnesota businesses fail because they lack capital. Here’s what to do about it.

Minnesota’s Department of Employment and Economic Development (DEED) has started a blog. In its introductory post, they have written a great primer on why new businesses fail, especially in Minnesota. The article discusses how a lack of planning often results in a lack of capital. From the article:

…a general lack of business knowledge and planning can have a very negative [e]ffect on an aspiring entrepreneur’s ability to secure bank loans, investment and credit. Without realistic projections of capital needs and anticipated revenues (all grounded in a thorough understanding of an industry), lenders simply do not have the confidence to lend.

Fueled by unrealistic expectations, too many overeager entrepreneurs start businesses on a financial shoestring. They underestimate how much time and cash they’ll need between startup and when they … begin generating adequate revenues or turning a profit. At the same time, they tend to overestimate their ability to attract bank financing. [emphasis added]

Let’s take a few minutes to try and solve the two major issues brought up by the article.

Jumping the Gun: Lack of Planning.

It is crucial that every startup plan appropriately. I have two resources that I recommend to first-time business owners or anyone starting in a new industry. The first is SCORE, which stands for Service Corps of Retired Executives. SCORE provides mentoring and counseling, local workshops and online webinars, as well as online tools, tips, and templates. They are a great resource for anyone working on refining their business plan. The second resource I recommend is the James J. Hill Reference Library. Through the website you can chat, call, or email with a business librarian who knows how to dig into the information you need. From building a business plan to researching new market opportunities, the Hill library probably has what you need. I have personally used the library when doing various research projects for our business and found their help to be top-notch.

Banks love history. Startups don’t have any.

The article briefly touches on something that we see over and over: banks typically do not lend to startups. This is because bank’s credit standards are built around reviewing a business’s history. Cash flow, profitability, and collateral are three key areas every bank will evaluate before they make a loan. Many startups aren’t yet profitable, have no collateral, and don’t cash flow. This makes them unbankable. In Minnesota, we have seen an increase in bank lending to startups in the past year, primarily through SBA loans.

Don’t sell your business short.

However, these SBA loans often are not large enough to provide adequate working capital. As the business grows it is strangled by the limited loan size. Every startup needs to ensure it has adequate working capital as it grows. Working capital is the lifeblood of your business. Too often businesses are profitable, but they fail because they run into a cash flow crunch. This is especially common in the world of startups. A common way to increase working capital is through accounts receivable factoring. By selling accounts receivable to a factoring company startups can have cash immediately upon invoicing instead of waiting 30, 60, or 90 days for payment. Factoring receivables also allows businesses to grow their working capital as their sales grow. This allows the business to finance huge growth opportunities.

Do you need working capital for your Minnesota startup?

Does your Minnesota startup need working capital? Is your business’s growth limited by your current SBA loan? Call Commonwealth Capital at (952) 469-4460 or contact us to talk about how we can provide the working capital you need to grow.