The Wall Street Journal recently published an article on the cash flow crunch many small businesses are experiencing. The article details how large corporations are boosting their profits, buying back stock, and paying dividends on the backs of their suppliers. From the article:

The move highlights how America’s biggest companies continue to build on the aggressive cash management practices they adopted in the wake of the credit crisis. What began as a way to preserve cash when markets dried up a few years ago has become a means of freeing up money to fund expansions, buy back stock and support dividend payouts at a time of lackluster sales growth and shrinking profit margins.

While the article doesn’t explicitly come out and say it, P&G is one prominent example of a company that is forcing their customers to factor their receivables.

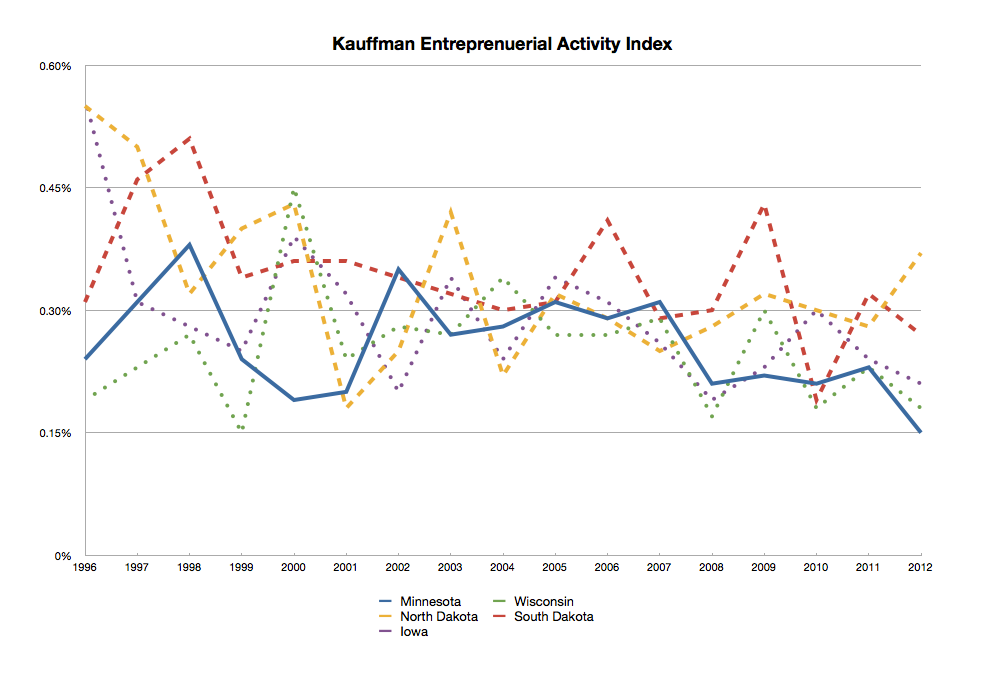

“Minnesota nice” doesn’t apply to payment terms.

Even in Minnesota, local businesses selling to big businesses are needing to finance accounts receivable. It’s likely that in the future, big businesses in Minnesota such as Target, Supervalu, Best Buy, 3M, Polaris, and many more will start extending payment terms to enhance cash flow. Invoices that used to take 30 days to pay can easily take 60 or 90 days to pay. Eventually, I would expect the suppliers will find a way to increase their prices and lower their costs to keep their net profit margins the same.

Are you experiencing a cash flow crunch?

If you’ve found yourself waiting longer than you’d like to get paid by your customers, we can help. We can rapidly improve your cash flow by providing accounts receivable financing. Please give Commonwealth Capital a call at (952) 469-4460 or fill out our form.