There are conflicting reports on the availability of credit to small businesses. Here I take a quick look and get lost in the fields of data.

I came across two articles today taking polar opposite views on small businesses and their access to credit.

The first report is from the US Treasury. In the Treasury’s report they discuss that over 90% of community banks participating in the Small Business Lending Fund have increased their small business loans since participating. The press release accompanying the report states:

…small businesses in a wide array of industries and in every region of the country have benefitted from the Treasury-administered program and that over 80 percent of small business loans made by SBLF participants were made in amounts of $250,000 or less.

The SBLF is another tool that some banks have been using to increase their lending, in addition to SBA loans. It’s good to see that the loans are truly going to small businesses, as indicated by the majority of the dollar value of loans being under $250,000.

In Minnesota, there are currently seven community banks and three non-profits participating in the SBLF. These banks have lent out a combined $80MM above the amounts they were lending to small businesses before participating in the program. The non-profits have lent out an additional $11.7MM.

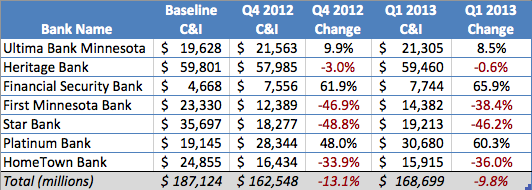

What was interesting is that as I dug deeper into the data, I saw a picture that was quite different from the headline. It turns out that while small business lending is up at the banks in aggregate, C&I loans, which is where loans for working capital to small businesses show up, is actually down by almost 10% in Q1 2013.

You can see the breakout of how the volume of working capital loans has changed. I wasn’t content to use the stale data from Q4 2012, seeing as the second quarter of 2013 just ended. So I added my own column using the data from the Q1 2013 Call Reports.

As the bank lending data above shows, while in aggregate lending to “small businesses” might be up by banks participating in the SBLF, in Minnesota the lending increase is coming from farm & agricultural lending. The total loans at these seven banks, either for agricultural production or secured by farmland, has risen by 113%, or $161.6MM, since the banks joined the program. And that’s without updating the data for Q1 2013.

That means if total lending by Minnesota banks in the SBLF is up by approximately $80MM, and farm & agricultural lending as a subset is up by $161MM, then C&I loans (term loans and lines of credit) and commercial real estate loans must be down by $81MM. If that’s representative of the entire banking sector in Minnesota, that is not good news for small business borrowing. Seven banks is a terribly small subset of data. Looking at the list, most of these banks are more rural banks, so I’m hoping that’s why the data is so skewed away from traditional business lending.

Despite this small business lending program and the great headline on the press release, I came across the second article at the American Sustainable Business Council. In their recent poll, almost half of small business owners say that access to credit is currently a problem for their business.

“It’s a serious problem for the economy that almost half of very small businesses still face a credit crunch five years after the financial crisis,” said Richard Eidlin, Director for Public Policy for ASBC. “The poll points to two obvious solutions to the access to credit problem: more well-regulated, financial services innovation and more competitive opportunities for local lenders.”

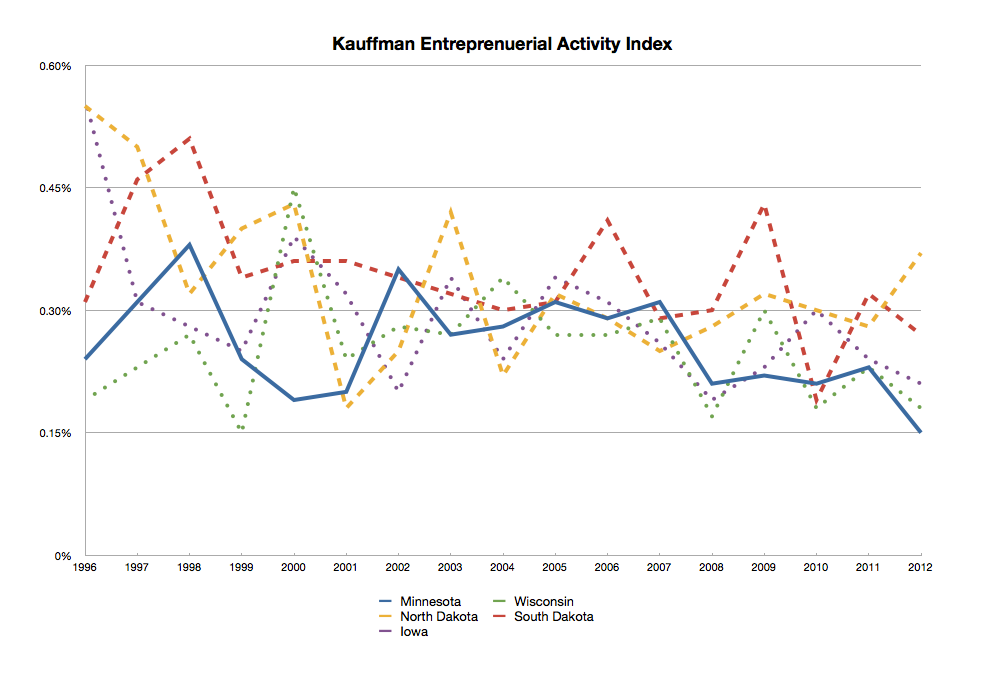

This article seems to be a better reflection of what’s actually happening in the market. While there are many small businesses that are able to access bank financing, there are still many companies who are unbankable. Bank lending, especially what is considered traditional business lending (operating lines of credit, term loans on equipment and commercial real estate), is still down and access for truly small businesses is still hard to find, especially for newer businesses.

Many small businesses find themselves in situations where their bank cannot meet their financing needs. These businesses look to alternative financing sources such as equipment leasing, invoice factoring, or asset-based lending to solve their working capital needs. These options are available for businesses that can’t wait for the local bank to make a yes or no decision on their loan. With quick access to working capital, businesses can focus on growth instead of worrying about finding a loan.